How to Build a Financial Safety Net Without a Six-Figure Income

For couples, families, and anyone trying to stretch every dollar a little further.

💭 Why This Matters More Than Ever

Bills don’t wait. Emergencies don’t knock. And no one sends a warning before your car breaks down or a medical bill shows up. If you’ve ever laid awake wondering, “What would happen if we lost an income?”—you’re not alone.

Here’s the truth:

You don’t need a six-figure salary to build a strong financial safety net.

You just need a plan that works where you are, not where the world says you should be.

This post is for you if you:

Live on a fixed income

Are raising a family

Are married or engaged

Are tired of living paycheck to paycheck

Let’s walk through this together—simply, clearly, and with compassion.

🧱 What Is a Financial Safety Net (and Why Most People Don’t Have One)?

Think of a safety net like the cushion in a circus:

If the tightrope walker falls, the net catches them.

In your life, the “fall” could be:

Losing a job

A surprise rent increase

Medical bills

A family emergency

A safety net = the savings, plans, and habits that help you land softly instead of crashing.

Too many people think a safety net has to be $10,000 or more.

Wrong.

It starts with just a little. And it builds.

🔄 Step-by-Step: Building Your Safety Net on a Modest Income

🪙 Step 1: Start With a “$500 Cushion”

Big goals can feel scary. So let’s start small.

Your first goal is $500 in a separate savings account.

Why? Because $500 covers:

A flat tire

A surprise co-pay

A busted water heater

How to do it:

Use a tax refund

Sell unused items on Facebook Marketplace

Cook at home for 2 weeks instead of eating out

🏆 Quick win = motivation to keep going.

🏦 Step 2: Open a Separate Savings Account

You need one place just for your safety money.

Out of sight = less temptation to spend it.

Look for:

Credit union accounts (often no fees)

Online savings with no minimum balance

Set up auto-transfers: Even $10/month matters.

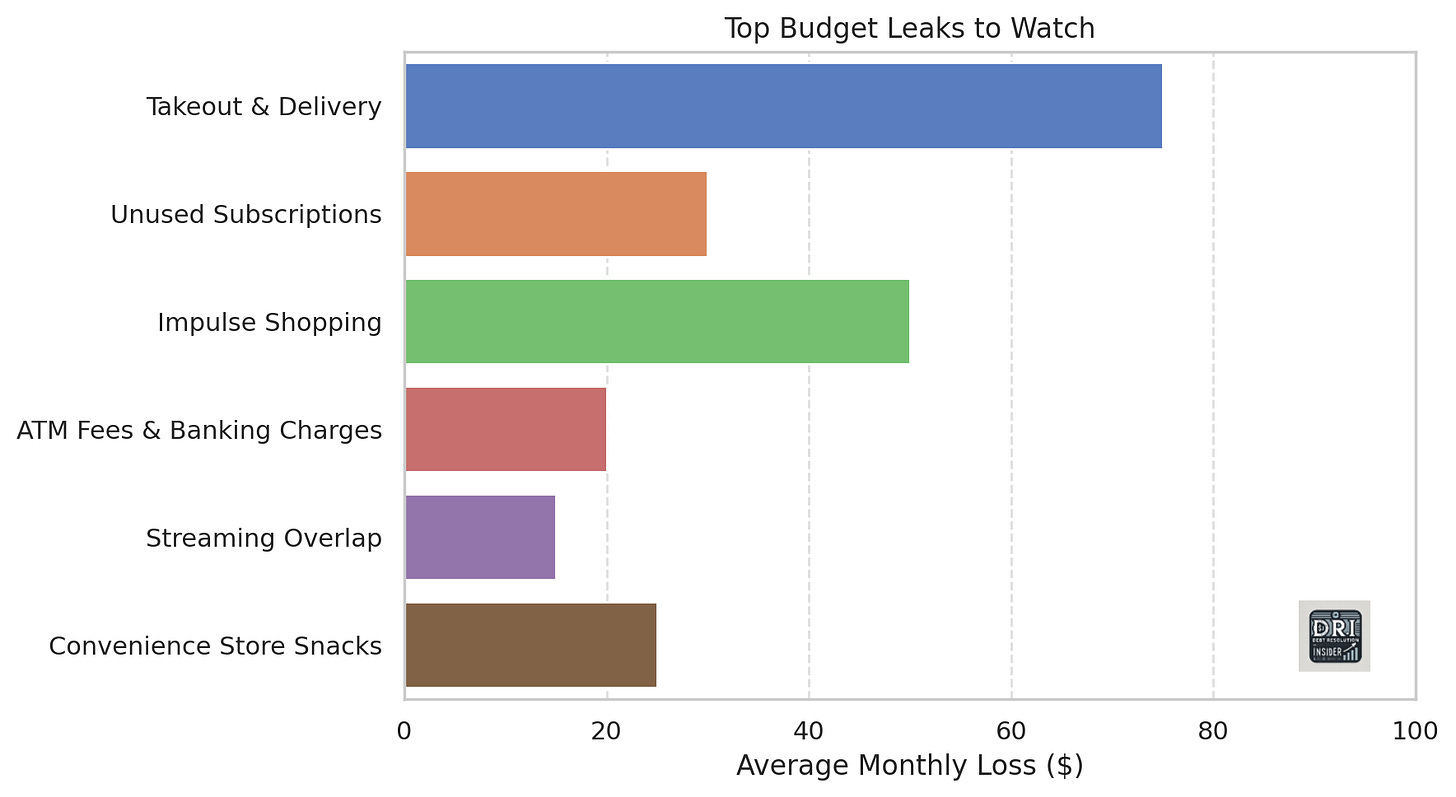

🧺 Step 3: Slash “Invisible Spending”

You’re not bad with money—you’re probably just leaking it.

Check:

Unused subscriptions

Fast food “just this once”

Shopping out of boredom

Try this:

Print out your bank statement. Use a highlighter to mark any expense that didn’t make your life better. You’ll be surprised.

📋 Step 4: Make a Mini Emergency Budget

If you lost income for a month, what’s the bare minimum you’d need?

List:

Rent/mortgage

Utilities

Food

Gas/transportation

Medications

That’s your “survival number.” Knowing it gives peace.

🧰 Step 5: Use Simple Tools to Stay On Track

You don’t need fancy apps. You need something that makes it easy to check in.

🧾 I built the Finance Hero’s Toolkit to help with:

Budgeting simply

Tracking progress

Making saving feel like a win, not a chore

Check your safety net weekly—just like brushing your teeth.

💬 Real Talk: “But I Have Kids, Debt, or Live on a Fixed Income…”

Let’s pause and be honest:

Some days, it feels like there’s nothing left to save.

But this isn’t about saving hundreds. It’s about building a habit.

Even $5 a month says:

“I’m planning for my future. I believe things can get better.”

Tips:

Look for energy assistance or food discount programs in your state

Use cash-back grocery apps

Celebrate every win — even a $1 transfer to savings

You’re not behind. You’re just beginning.

💞 Couples: Build the Net Together, Not Alone

Money stress can divide couples—but it doesn’t have to.

Try this:

Set a “money date” once a month

Ask:

What’s one money win we had this month?

What are we saving for together?

What’s one habit we could improve?

Teamwork builds trust. And trust builds stability.

📈 After the Net Comes Confidence

Once your net is in place, you can:

Pay down debt faster

Plan for a vacation (yes, that’s allowed!)

Say “no” to bad loans

Sleep better at night

Your financial safety net is more than money—it’s peace of mind.

You’ll walk taller. You’ll argue less. You’ll stop surviving and start living.

Ready to Start?

Pick one thing today:

Open a savings account

Save $20 from your next check

Cancel a subscription

Share this post with your spouse and talk about it

💼 Need help? Download the Finance Hero's Toolkit — it includes a beginner budget, savings tracker, and more.

You don’t need a six-figure income.

You just need a six-second decision to start.